Life Insurance in and around Shorewood

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

No one likes to entertain ideas about death. But taking the time now to plan a life insurance policy with State Farm is a way to demonstrate love to the people you're closest to if you die.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Life Insurance You Can Trust

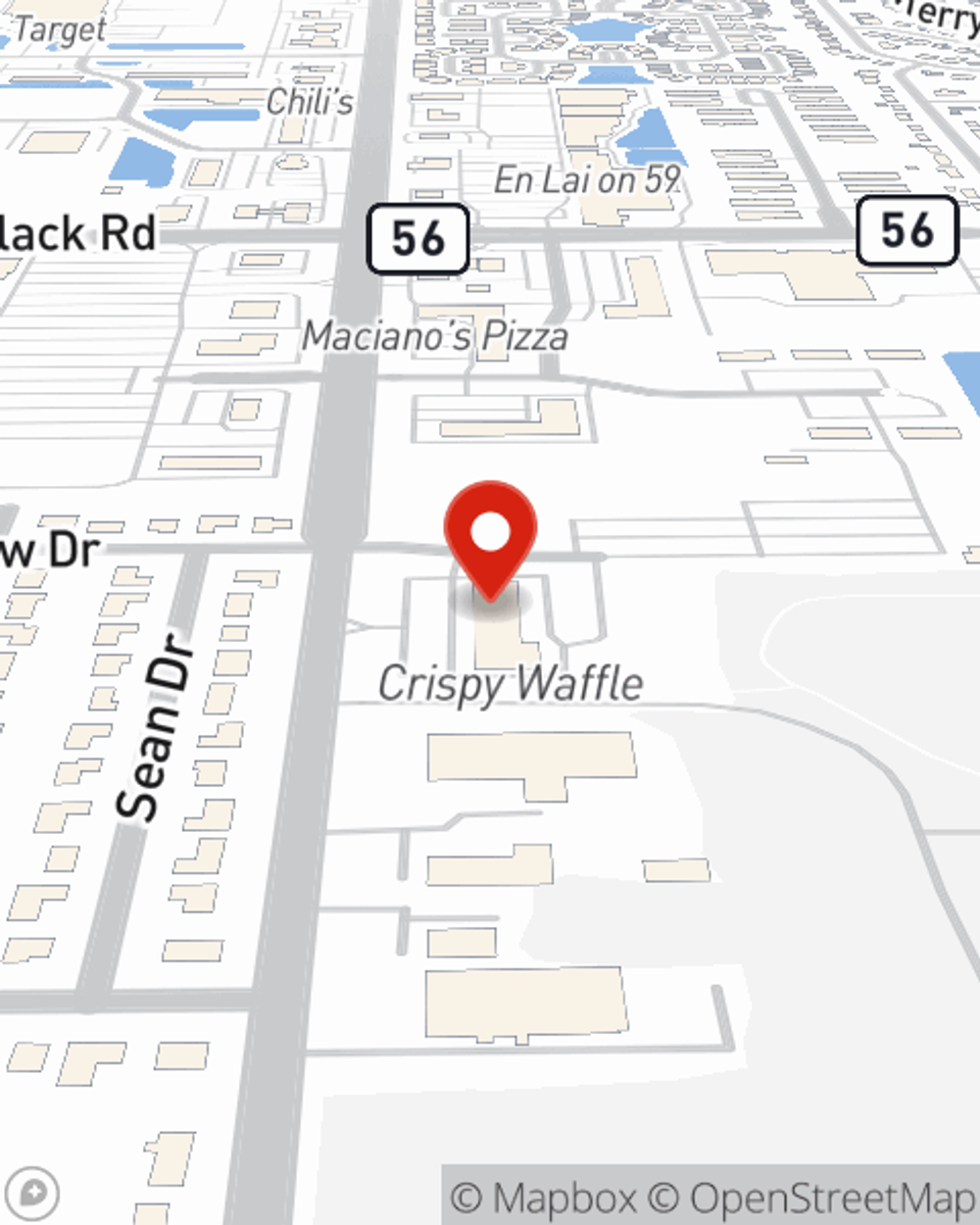

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Lucy Brogla. Lucy Brogla is the compassionate person you need to consider all your life insurance needs. So if you pass, the beneficiary you designate in your policy will help your partner or your family with matters such as college tuition, retirement contributions and your funeral costs. And you can rest easy knowing that Lucy Brogla can help you submit your claim so the death benefit is paid quickly and properly.

When you and your family are protected by State Farm, you might sleep well at night knowing that even if the worst comes to pass, your loved ones may be protected. Call or go online now and discover how State Farm agent Lucy Brogla can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Lucy at (815) 741-2255 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Lucy Brogla

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.